Funded accounts have become extremely popular among traders looking to grow faster without risking their own capital. If you have been researching prop trading opportunities, chances are you have come across dozens of firms offering “fully funded” or “instant funding” accounts.

But here is a question many traders ask:

What is the downside of a funded account?

In this blog, we will break it down in plain English, explaining the pros and cons, what to look out for, and how to make the most of funded account opportunities. We will also share how TradingFunds is solving some of the biggest problems traders face in the industry.

Let’s dive in.

First, What Is a Funded Account?

A funded account is a trading account provided by a proprietary (prop) trading firm. These firms give you access to a set amount of simulated capital. For example, $25,000, $50,000, or even $100,000. You then trade with that capital under the firm’s rules.

If you meet certain profit targets and risk guidelines, you can earn a profit split from the returns. Some firms pay weekly, bi-weekly, or monthly.

Sounds great, right? It can be. But there are some important downsides to understand before jumping in.

1. Challenge Pressure and Evaluation Phases

One of the biggest downsides of a funded account is the evaluation process. Most firms require you to pass one or two phases before they give you access to a funded account.

You may be asked to:

-

Hit a profit target (e.g. 8% or 10%)

-

Stay within drawdown limits (e.g. 4% daily, 8% total)

-

Follow consistency rules

-

Avoid certain trading hours or news events

This can create pressure, especially if there is a time limit involved. Many traders feel forced to overtrade or take unnecessary risks just to pass the challenge.

How TradingFunds Helps

At TradingFunds, we offer a Pay After You Pass model. That means you do not pay for the full challenge upfront, you only pay once you pass. We also give you unlimited time to complete the evaluation and a simple 1-step model with clear rules.

This reduces pressure and helps traders focus on trading well—not just rushing to beat a clock.

2. Strict Rules and Trading Restrictions

Another common downside is that many prop firms set strict rules that are hard to follow in real-world conditions. These might include:

-

Bans on trading news events

-

Restrictions on holding trades over weekends

-

Maximum lot size limits

-

Daily consistency requirements

If you break even one rule—even if you are profitable—your account could be breached or terminated.

How TradingFunds Helps

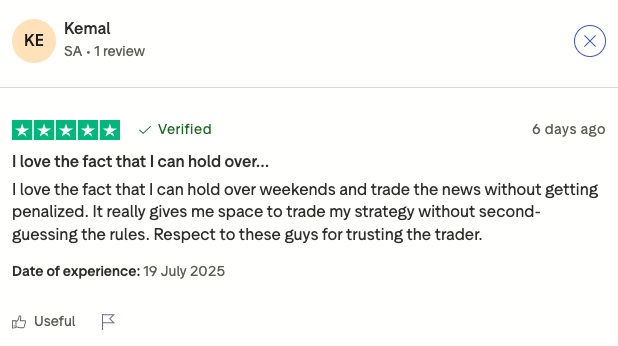

With TradingFunds, you are allowed to trade news and hold trades over the weekend. We keep our rules simple and fair. No hidden clauses. No tricky fine print. Just clear guidelines that let you trade your strategy without being penalized for being active.

3. Low Payout Flexibility

Some prop firms limit how often you can withdraw profits, especially in the early stages. You might be required to wait 30 days or more for your first payout.

In some cases, you only get a small percentage of your profits at first. For example, the first payout might be capped, or your split might start low (like 60%) and only grow over time.

How TradingFunds Helps

At TradingFunds, payouts are bi-weekly and start from just $100. There are no payout caps, and we offer up to 90% profit split as you scale through levels. You can even add an option to get your first payout in 7 days after funding.

4. Lack of Real Growth Opportunities

Not all prop firms allow you to scale your account. Even if you perform well, your account might stay stuck at the same size with no chance to grow.

This limits your earning potential, especially if you are looking to build a long-term trading career.

👉 How TradingFunds Helps

We offer account sizes from $5,000 to $100,000, and you can scale up to $600,000. With our level system, your profit split also increases as you progress. It is real, structured growth based on performance.

5. High Upfront Costs

Let’s be real: some prop firms charge hefty fees just to attempt the challenge. These can range from $100 to $500+ depending on the account size.

If you fail the challenge, you often have to pay again to retry. That adds up fast—especially if you are still learning or developing your strategy.

How TradingFunds Helps

Our Pay After You Pass model flips the script. You only pay the full fee after you prove yourself. To start, all you need is a $9+ broker setup fee. No more burning money on evaluations you might not pass.

6. No Real Capital (Simulated Funds)

It is worth noting that most funded accounts use simulated capital. This means you are not trading with the firm’s actual money, but rather in a live environment that mirrors real conditions.

While this is standard practice, some traders feel disappointed when they learn their trades are not directly affecting live markets.

However, payout earnings are real, and simulated trading helps firms manage risk while still rewarding good traders.

Why That Is Not a Bad Thing

At TradingFunds, we are transparent about using simulated funds. It keeps things safe, stable, and scalable for both sides. And it does not affect your ability to earn real payouts for solid trading performance.

7. Account Termination and Inactivity

Many firms will close your funded account if you break a rule or remain inactive for too long. That means your hard work can vanish overnight if you are not careful.

How TradingFunds Helps

We believe in giving traders room to breathe. We offer clear reset options and low-pressure timelines, and we notify you of any issues before taking drastic action. Our goal is to help you stay funded—not punish you for being human.

Final Thoughts: Are Funded Accounts Worth It?

Yes—if you choose the right firm.

Funded accounts can be a powerful way to:

-

Accelerate your trading journey

-

Build capital without personal risk

-

Develop discipline and structure

-

Earn from your skill without putting your own money on the line

But the wrong firm can create unnecessary stress, hidden rules, and slow progress.

That is why TradingFunds exists—to give traders a better path.

✅ Pay After You Pass

✅ No upfront evaluation fee

✅ Simple rules, no hidden restrictions

✅ Bi-weekly payouts from $100

✅ Scale up to $600,000

✅ Profit split up to 90%

✅ Real support and real opportunities

Ready to Start?

If you are serious about growing as a trader and want a funded account that works with you, not against you—join thousands of traders already building with TradingFunds.